Proposed one-cent sales tax estimated to bring in $500 million over 10 years

A one-cent surtax will be on the ballot in St. Johns County during the 2022 general election Nov. 8 and the early voting period Oct. 26 to Nov. 5.

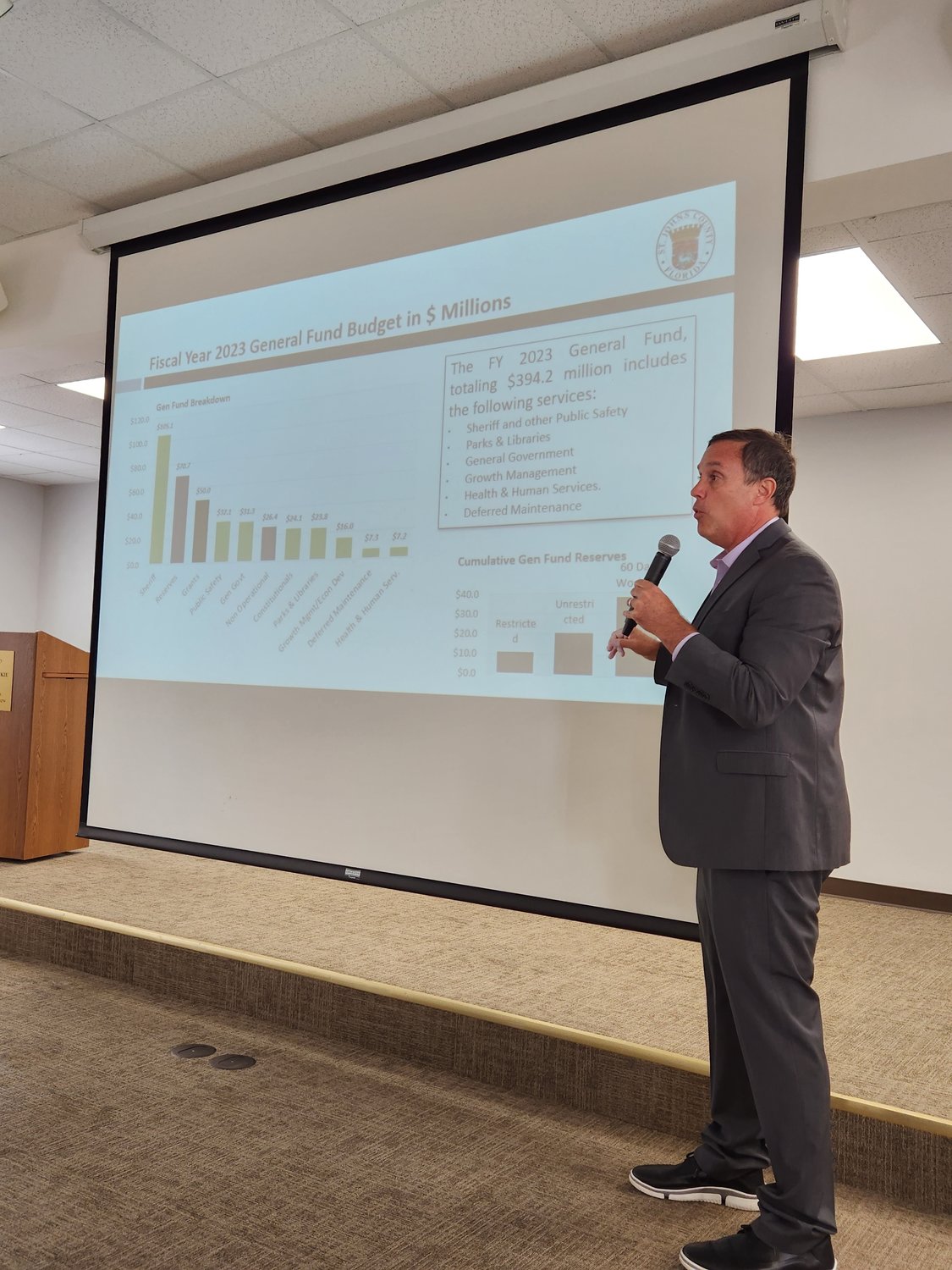

Jesse Dunn, director of the office of management and budget with the St. Johns County Board of County Commissioners spoke to the Ponte Vedra Beaches Coalition during its October meeting and provided insight into both the budget and the proposed tax.

According to Dunn, if the tax is passed, an additional estimated $49 million yearly would be put into a fund or bank account and set aside to be used for capital infrastructure-related projects.

The county has approved a $1.5 billion fiscal year 2023 budget, which Dunn warned seems like a lot, but $958 million of the funds are restricted and must only be used on specific departments and their operations.

$394.2 is what is allotted in the general fund, which is the least restrictive of the funds and can be used in a variety of ways.

“When people say that St. Johns has a similar budget to Jacksonville, that is true, but they don’t have to worry about some of the same things, such as utility operations, because JEA (Jacksonville Electric Authority) is not included in their budget figures,” Dunn said.

Another way Dunn emphasized that St. Johns County differs from Duval County is the number of government-run entities that St. Johns County owns, such as the Ponte Vedra Concert Hall and St. Augustine Amphitheater.

“Be careful making that comparison,” Dunn said. “It really is a different storyline.”

If the sales tax was to pass it would be in place for 10 years and after a decade would need a referendum to keep it on the books and extend it further.

Dunn stated that all the one-cent sales tax funds would be used on differed projects deemed to be able to be completed in a five-year span.

The projects are those which the county had been presented a masterplan but backlogged because the funds were not in place at the time to complete.

If approved, he estimates that the new sales tax would generate about $500 million over the next 10 years.

“We’re not supposed to be proponents for this (tax) one way or the other,” Dunn said.

According to Dunn, he has heard some misconceptions among the public and he wanted to clear up that homesteaded properties under the state’s “Save Our Homes Exemption” can only see a property appraiser assessment at the maximum increase of 3%, even at the proposed “flat” millage rates.

The Commission voted to place the proposed sales tax increase on the ballot during its March 15 meeting and more than 50% of voters would need to be in favor of to go into effect beginning January 1, 2023.